|

A Brief Summary and Comment on the Original APDP

(Note that amendments announced in November 2015 are covered at the end of this article)

The Automotive Production and Development Programme (APDP) replaced the Motor Industry Development Programme (MIDP) on January 1st, 2013.

Please note that this program applies to light vehicles only, and that there are separate regulations to support future heavy vehicle production, which are covered at the end of this article.

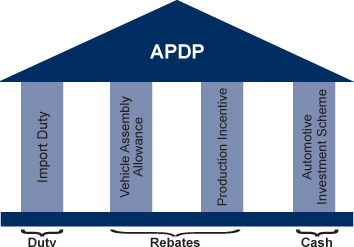

The APDP consists of 4 pillars that drive the programme:

-

Import Duty

-

Vehicle Assembly Allowance (VAA)

-

Production Incentive (PI)

-

Automotive Investment Scheme (AIS)

Tariffs: Import duties on vehicles and components have been frozen at 2012 levels (25% on light vehicles and 20% on components) through to 2020. A preferential agreement results in imported vehicles from the EU paying only 18% duty.

Comment: Because of the continual increase in imported vehicle share of the market, there are many who have called for an increase in these duties, particularly as South African tariffs are lower than those in most developing countries. Furthermore, these duties can be rebated under the APDP, similar to the MIDP, so effective protection can be as little as zero.

It should also be noted that the United States protects its large pickup market with a duty of 25%, which is even higher than in South Africa as it is based on the CIF price as opposed to FOB. NAACAM believes the government should reconsider the nominal and real protection for both vehicles and components.

Vehicle Assembly Allowance (VAA): This support is in the form of duty-free import credits issued to vehicle assemblers based on 20% of the ex-factory vehicle price in 2013, reducing by 1% in 2014 and from 2015 to 18% of the value of light motor vehicles produced domestically. The equivalent value of this to the vehicle assemblers is the allowance multiplied by the duty rate, so 4% in 2013 reducing to 3.6% in 2015.

The VAA is based on all local production so that exported vehicles, which pay no duty on imported parts, will still get the full VAA.

Comment: The VAA is more generous than the D-FA earned in the MIDP for those vehicle assemblers with a high proportion of vehicle exports, since the duty credits earned on these vehicles will be used to offset imported components for vehicles produced for the local market. So for example an OEM exporting half its vehicle production earns an equivalent 40% VAA on vehicles produced for the local market, compared to the 27% D-FA in the MIDP. This has resulted in some OEMs having surplus credits, and the legislation allows these to be carried over to a following quarter or sold.

Production Incentive (PI): From 2013 this support started at 55% reducing by 1% annually to 50% of value added (52% in 2016), and is also in the form of duty-free import credits. Certain products, identified as “vulnerable products”, earned a PI of 80% in 2013 and 2014, reducing thereafter by 5% annually to 50% in 2020 (70% in 2016).

Value added is defined as the manufacturer’s selling price less the value of non-qualifying material and components. The incentive is calculated through the supply chain and is earned by the end producer, which is the vehicle assembler, or the component manufacturer in the case of component exports and aftermarket sales. There are certain eligibility requirements to ensure that the beneficiaries are companies producing substantial components for vehicle assembly, and to exclude accessories.

While generally materials are excluded from value added, certain materials, which have been locally beneficiated to suit automotive specifications, have a standard 25% of their value included in the value addition, or 40% (reducing by 5% annually from January 2015 to 25% in 2017) where they are used to produce vulnerable products.

The equivalent value of the PI is the incentive multiplied by the component duty rate of 20%, so 11% of normal value added in 2013, reducing to 10% by 2018.

Comment: This is the incentive intended to encourage local component production. Component exporters earn a significantly lower incentive than in the MIDP, and this may have a negative impact on future exports, particularly those with high raw material content, such as catalytic converters and steel and aluminium based products.

This is why the authorities agreed to the industry’s request that special consideration be given to additional support for these high material content vulnerable products to avoid a sudden and significant loss of export business. These are the vulnerable products:

(a) Alloy wheels;

(b) Aluminium products (Engine and transmission components, heat exchangers and tubes therefor, suspension components and heat shields);

(c) Cast iron components (Engine/axle/brake/transmission and related types of components);

(d) Catalytic converters;

(e) Flexible couplings;

(f) Leather interiors;

(g) Machined brass components; and

(h) Steel jacks.

The materials which have a standard value added when originating in South Africa are:

(a) Aluminium;

(b) Brass;

(c) Leather;

(d) Platinum group metals;

(e) Raw automotive glass;

(f) Stainless steel; and

(g) Steel.

South African producers will have to improve their global compet-itiveness in order to be able to secure new export contracts in future years.

It will also be important in terms of the localisation of components for the vehicle assemblers to properly recognise the PI in evaluating a local part against an imported one, instead of simply comparing local costs against the ex-works or landed costs of imported components, as some do at present. It has been agreed that failure by OEMs to recognize this will result in a review and possible change to allow the tier 1 component producer to earn the PI instead of transferring the value addition to the OEM.

Additional Comments on the Programme: When the allowances and incentives are accumulated, the vehicle assemblers received, on average, a higher benefit in 2013 than in 2012 under the MIDP and this continues to be the case. The extent of the increase is affected by the ratio of vehicles produced for the domestic market to exports. On the other hand, component manufacturers in total receive less as a result of the removal of the present export incentive.

While NAACAM supports the need to incentivise the vehicle assemblers in South Africa, we believe the generous levels have meant that overall there is little “stretch” for OEMs to increase localisation of components.

Furthermore, we believe component suppliers should receive a more direct benefit, and are concerned that the structure of the new program may not result in the higher levels of local content required to offset the probable reductions in exports, resulting in lower overall component volumes than at present.

Without higher localisation, it may become increasingly difficult to justify producing some vehicles in South Africa, and thus the target of continually increasing local production may be unachievable.

Heavy Commercial Vehicles

The authorities continue to investigate possible incentive measures for medium and heavy commercial vehicles, trailers, buses and related off-road vehicles.

Components for Medium and Heavy Commercial Vehicles and Buses

A PI under the same regulations as for light vehicles can be earned on components produced for heavy commercial vehicles. The PI will, however, be earned by the component manufacturer and not passed through to the vehicle assembler as is done on light vehicles.

Minister’s Statement

History

In September 2008 the dti announced the details of the APDP, which was to replace the then automotive sector-specific programme, the MIDP. The APDP was fully implemented by January 2013 with a view to steer the automotive industry towards producing about 1.2 million vehicles by 2020, with attendant expansion of the domestic supplier base.

Since the original APDP framework was developed in 2008 the global and domestic economy changed dramatically, raising a concern that there could be limitations in the program that may lead to failure to achieve set objectives for the industry.

In February 2014 the dti engaged the services of a specialist advisor to co-ordinate a review of the APDP with a mandate to make recommendations to secure optimal outcomes for the sector and economy, whilst retaining long-term certainty for investment.

Process

The appointed advisor, Mr Roger Pitot, worked with a team of officials from the dti and TIPS and interacted with industry stakeholders such as NAACAM, NAAMSA, NUMSA as well as officials from the National Treasury. The final proposals were arrived at after several interactions with industry stakeholders at various levels, culminating in a consideration by Cabinet.

Findings

The 2020 target of producing 1.2 million vehicles per year is unlikely to be achieved due to a variety of reasons such as the fact that the global economy is still recovering from the effects of the 2008/9 financial crisis. Secondly, it will also be extremely difficult to achieve significant expansion and deepening of the local supplier base under the prevailing conditions.

Key Proposals

In an effort to sustain and grow the industry, whilst steering it towards the APDP vision of high volume vehicle production, the following proposals will be implemented;

a) A post-APDP support framework will be developed during the course of 2016 in order to provide a certain policy environment for automotive manufacturing in SA after 2020.

b) The volume threshold for vehicle production will be reduced from 50 000 units to 10 000 units per annum in order to allow new entrants into the local industry.

c) The Volume Assembly Allowance (VAA) will be offered on a sliding scale based on volume commencing at 10% for 10 000 units to 18% at 50 000 units from January 2016.

d) A suitable capital incentive (AIS) level will be provided for new entrants at the less than 50 000 pa threshold.

e) The production incentive for catalytic converters will be frozen at the 2017 level of 65% rather than continue the phase down.

f) The qualification for component suppliers to earn APDP benefits will be tightened in order to avoid these being earned on non-core automotive products and priority afforded to those products that add value in the value chain.

g) Lastly, cabinet has mandated an approach to the National Treasury for higher investment support for tooling as a means of encouraging further component localization. Overall national budget constraints are noted in this context.

Strategic Direction: Government remains committed to further

development of the automotive industry in line with the National Industrial Policy Framework (NIPF) and the Industrial Policy Action Plan (IPAP). Long-term development of the sector will be achieved through high vehicle production volumes and associated local value addition.

Other Policy Imperatives: As we develop a post-APDP automotive master plan we will also actively engage the industry in efforts that seek to promote meaningful transformation of the industry through the inclusion of previously excluded groups in the entire automotive value chain. The current situation is characterized by extremely low participation of Blacks in the automotive industry. This is prevalent through all parts of the sector’s value chain, including distribution, retail and aftersales/service. The levels of support afforded to the industry in SA need to be reflected through an appropriately transformed sector.

Implementation Plan: As we set up the necessary regulatory amendments and administration system for the programme, we will ensure that it is in line with the need for a strong monitoring and evaluation system, but still not unduly burdensome to stakeholders.

NAACAM’s Comment

NAACAM welcomes Governments’ continued support for the auto-motive sector.

Two years since the introduction of the APDP, vehicle assemblies in South Africa continue to grow albeit modestly, despite poor local and global economics. The review announcement by Minister Davies on Friday 6th November will ensure continued growth, legitimizing Governments’ continued support.

Having digested the contents of the announcement, we are disappointed that this review did not yield more meaningful requirements for local manufacture of components and subassemblies. In spite of vehicle assemblies growth, real local content percentages have declined in this period, especially in the manufacturing sub sector, most notably at Tier Two level, where real employment, skills development and transformation opportunities lie.

The announcement of lower VAA thresholds may welcome new participants, but will do little to change this local content deterioration.

NAACAM is cognisant and appreciative of significant OEM invest-ments based on the principles of the APDP, but with no changes to the current parameters for another five years, we are concerned that the component manufacturers will find it more challenging to compete on a sustainable basis.

NAACAM will work actively with all the Automotive Industry stakeholders to bring about the required changes to the programme post 2020 that will result in real localisation and job creation, whilst finding the appropriate stability and balance in the industry. |